This is how to charge VAT ON RENT INVOICE for an individual tenancy:

- Open the property page

- Under the Details tab find Property type.

- Make sure this is set to Commercial.

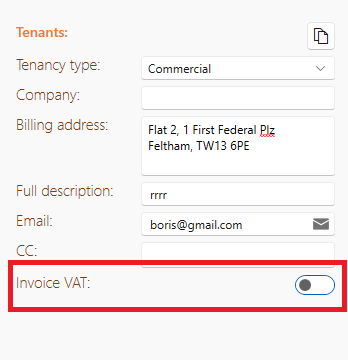

- Open the tenancy page.

- Under the Details tab find the Tenants section.

- Set Tenancy Type to commercial.

- At the bottom of the section switch Invoice VAT to on.

- All new invoices created for this tenancy will have VAT included.

- All new invoices created for this tenancy will have VAT included.

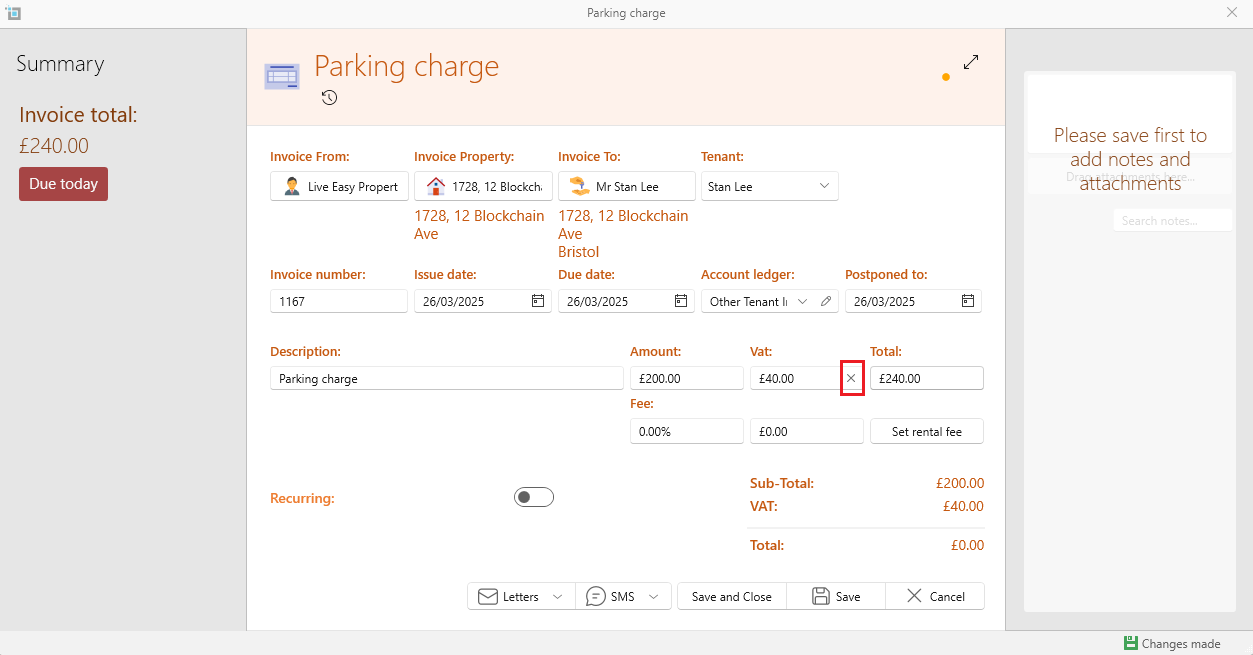

- If you create a manual invoice, this will also have VAT included.

- If you create an invoice from the manager to the tenant, this will be based on whether the manager has VAT registered switched on.

- You can always change the VAT to be switched on by checking the tick next to the VAT option, or to switch it off by checking the cross next to the Vat option.