Follow the process below when becoming a VAT registered company.

Charging VAT on commission.

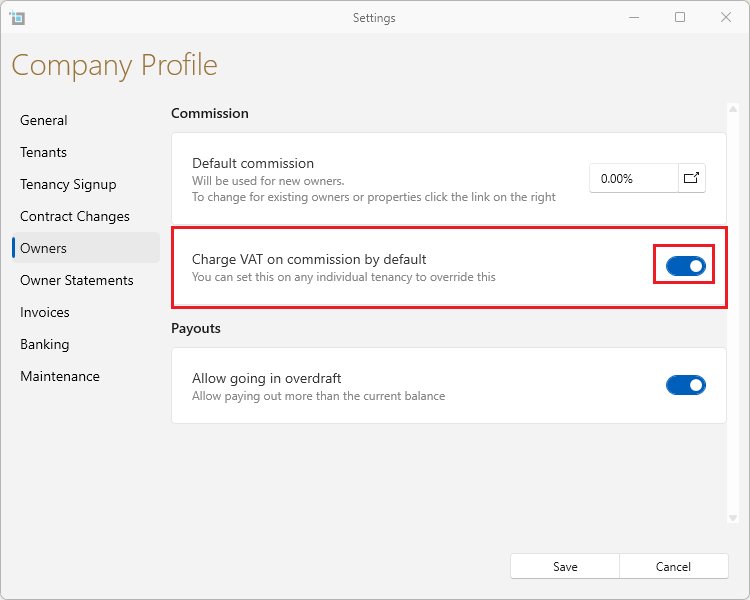

First let's change the setting to automatically charge VAT for commission for all new leases entered in SleekTech.

- From the main software ribbon go to Control Panel.

- Click Settings.

- Select Owners tab.

- For "Charge VAT on commission by default" Slide the toggle to the on position

- Click Save.

Next let's update all existing leases to charge VAT for commissions.

- From the main software ribbon go to Manage Leases.

- Make sure View All Leases is selected and all leases are shown.

- If the table is filtered, click Unfilter All.

- Click on the Checkbox in the top left corner of the columns to select all.

- On the window ribbon select Bulk Action.

- Select Commission VAT.

- Save.

Updating existing payments.

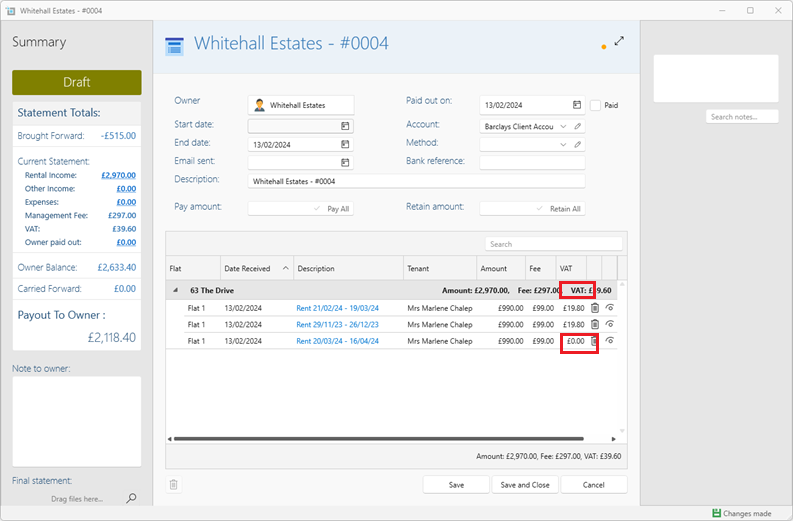

Any previously created rental payments will not be changed therefore to add vat to previous rental payments follow the instructions below:

To check what rental payments have not yet had the vat applied create an owner statements, and work on it whilst still in preview mode (as once saved you will not be able to edit any transactions).

Going through the process like this will give you the control to check each rental date to see that it was a charge from when you became VAT registered and not from before.

If the vat column is showing £0.00 and the rental dates is from after you became VAT registered you will know you need to un-apply and reapply the payment for the vat to show up.

This is done as follows:

- Click on the blue rental period

- On the payment window select un apply all

- Tick the Check box for the required invoice again and press save.

- Close the statement preview - Reopen it and check that the vat is now showing

You can do multiple edits in a go, you do not need to close the preview each time. However your changes will only show up once the preview has been closed and reopened.

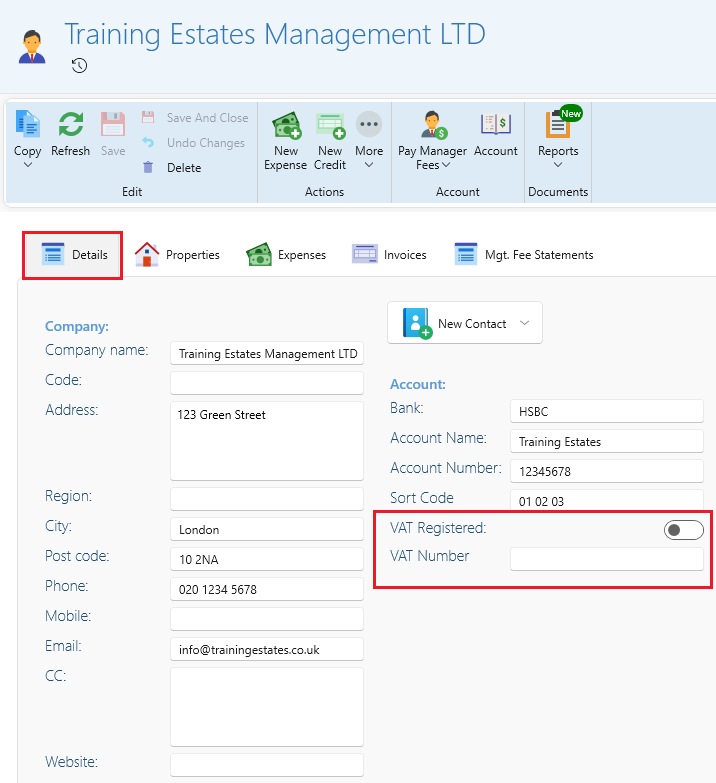

Implementing your VAT number and VAT totals on statements and manager invoices.

On the manager page you will need to switch on the VAT registered toggle and put your companies Vat number in.

Next you will need to check that your statements and manger invoices are showing your vat number and vat totals.

You may need to contact us to insert it for you.